Have any questions about the company's holdings, strategy & policies?

We encourage new, existing and prospective investors to book an appointment to access the portfolio management team.

Our Strategy

The company invests its capital in companies with a significant discount in the share price relative to perceived inherent value.

These companies have superior fundamental prospects, yet negative external events have attracted a flight of investors.

The company seeks to assist investee companies to demonstrate, grow and realise their inherent value.

What We Look For

Conservative

Balance

Sheet

Trading

Below Intrinsic Value

Sub

$300M

Market Cap

Board and Management

Own > 10%

Catalysts to Realise Inherent Value

Dividend/Distribution Policy

The Company intends to pay dividends to Shareholders, where and when available, from the dividends received from underlying Portfolio Companies, and a portion of realised profits from the sale of securities in Portfolio Companies, provided that the Company has sufficient profit reserves and franking credits, and it is within prudent business practices to do so.

As the investment strategy of the Company includes long term capital growth through investments in ASX-listed companies with a market capitalisation of up to $300 million, it is possible that dividends may be low (or nil) in any given period. In particular, there is a risk that dividends received from underlying Portfolio Companies may be low (or nil) during initial investment years due to the nature of the Portfolio Companies and their stage of commercialisation, which may impact on the Company's ability to pay dividends to Shareholders and the size and level of franking on any such dividend.

However, the amount of any dividend will be at the complete discretion of the Board and will depend on a number of factors, including expectations of future earnings, capital requirements, financial conditions, future prospects, laws relating to dividends and other factors that the Board deem relevant. It is the current policy of the Board that all dividends paid to Shareholders will be franked to 100% (or to the maximum extent possible without incurring liability to franking deficit tax). However, no assurances can be given by any person, including the Directors, about the payment of any dividend and the level of franking on any such dividend.

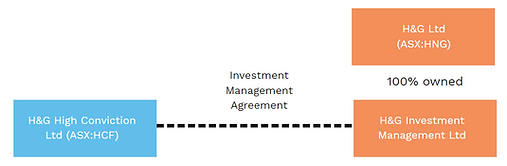

Current Structure / Organisation

*charged by the investment manager, H&G Investment Management Limited

Fees*

Management Fee

1% of gross asset value plus GST p.a. paid monthly in arrears

Performance Fee

20% of pre-tax benchmark outperformance, with a highwater mark, paid semi-annually

Benchmark

5% P.A.

Our Goals

The company is aiming to provide its investors with access to:

-

a highly experienced and active investment manager with expertise and a strong track record in ASX-listed equities;

-

a concentrated portfolio of approximately 20 – 25 investments in ASX-listed micro capitalisation companies (with market capitalisations under $300 million at the time of the initial investment);

-

an actively managed, fundamentals-based investment approach with a focus on capital preservation, long term capital growth and income from its investments; and

-

targeting attractive performance of at least 10% per annum (after all fees).

Important Information & Documents

Share Registry

Registry Direct Limited

PO Box 18366

Collins Street East

Melbourne VIC 8003